Last update: 04-03-2025 00:00 UTC

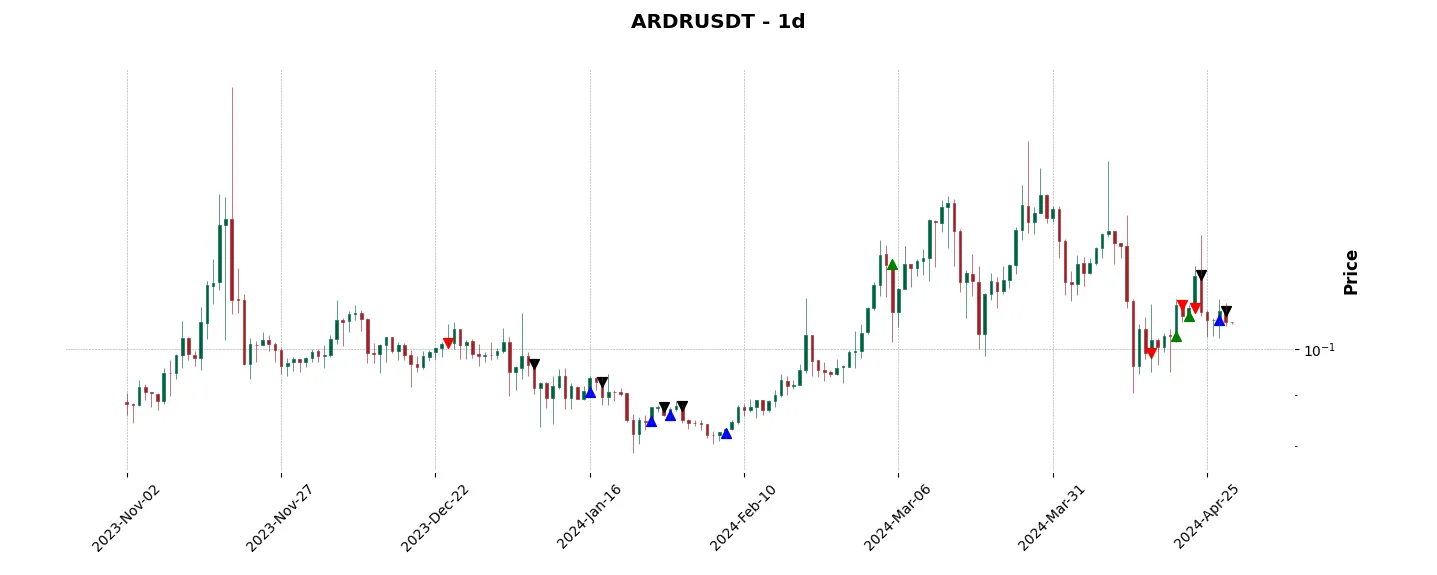

Top trading strategy Ardor (ARDR) daily – Live position:

- Open short

- Entry price : 0.06413 $

- Pnl : %

Trade history

Over 6 months

Complete

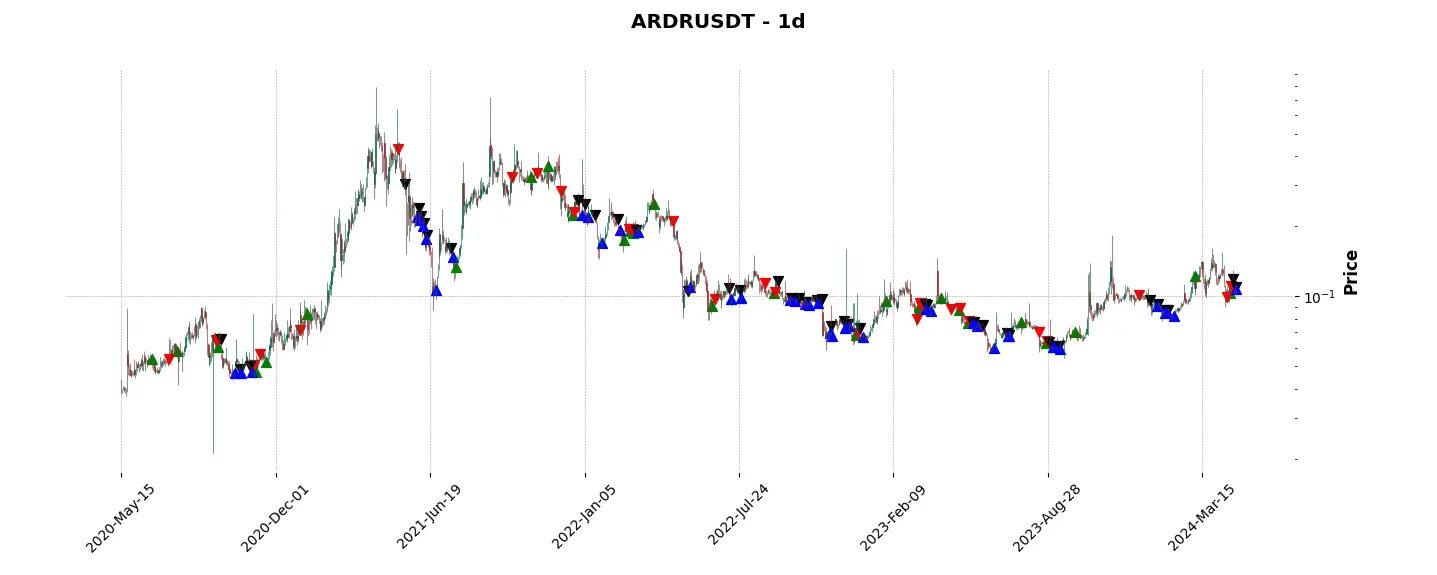

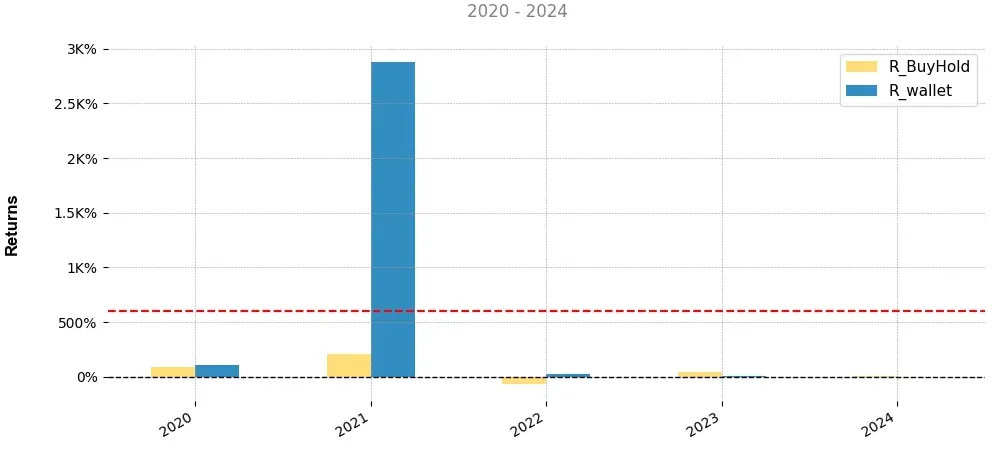

«Top trading strategy Ardor (ARDR) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy ARDR daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

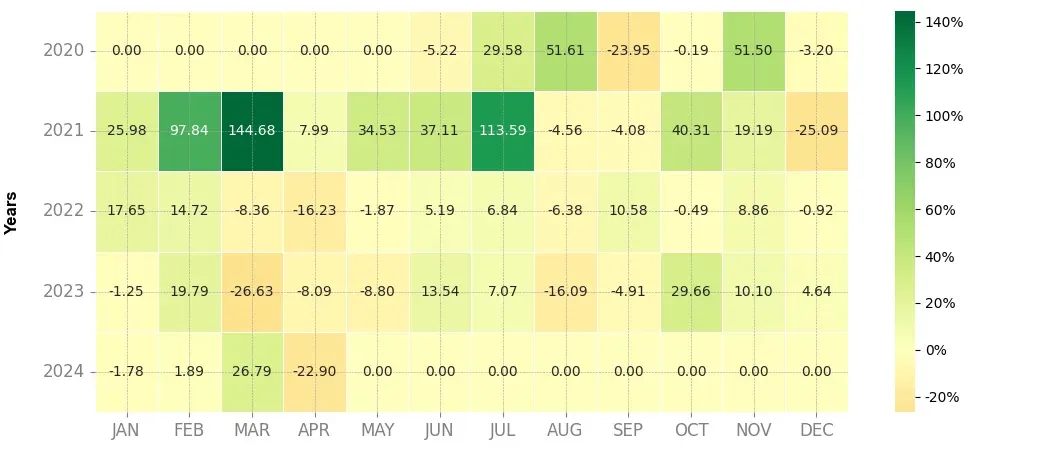

Heatmap of monthly returns

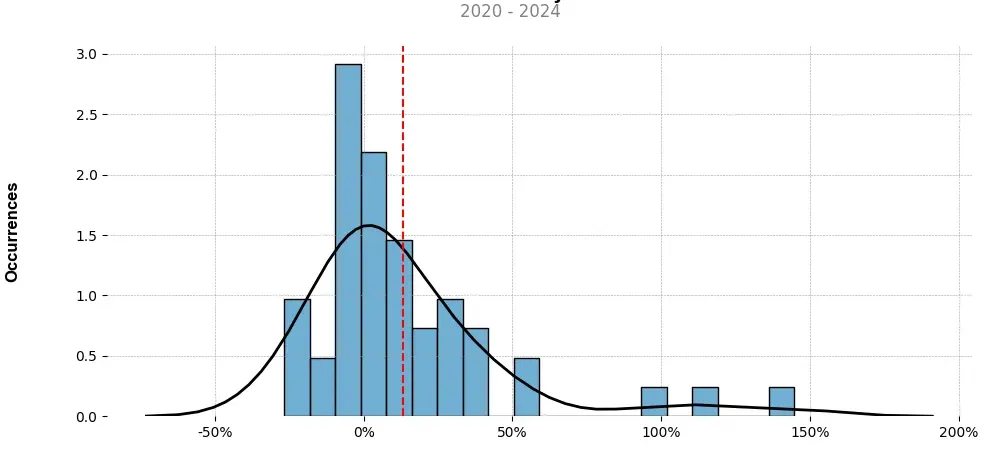

Distribution of the monthly returns of the top strategy

Presentation of ARDR

Ardor (ARDR) is a blockchain platform designed for businesses, addressing the scalability and flexibility limitations faced by other cryptocurrencies. It offers a unique architecture called a parent-child chain structure, making it a compelling solution for various use cases. This synthesis will outline the features, use cases, and advantages of Ardor as a blockchain platform.

Firstly, Ardor employs a scalable approach by separating transactions and security. The main blockchain, known as the Ardor parent chain, is responsible for processing security-related tasks like consensus, while lightweight child chains handle the transactions. This architecture allows child chains to function independently, enabling businesses to create their specific blockchain applications while benefiting from the security of the parent chain.

Moreover, Ardor introduces a range of built-in features, known as the Ardor Blockchain-as-a-Service (BAAS) offerings. These include secure messaging, voting systems, account control, decentralized asset exchange, and data cloud, among others. These features provide businesses with a ready-to-use infrastructure, eliminating the need for additional development and customization, and helping them accelerate blockchain adoption.

One of Ardor’s notable use cases is for enterprises seeking to implement blockchain technology. With Ardor, businesses can integrate blockchain solutions easily and effectively. Its child chain architecture allows companies to launch their private or public blockchain networks tuned to their specific requirements. This flexibility makes Ardor an attractive platform for industries like supply chain management, finance, healthcare, and more.

Another key advantage of Ardor is its energy-efficient consensus mechanism, known as Proof of Stake (PoS). Unlike other popular cryptocurrencies like Bitcoin, which rely on Proof of Work (PoW) mining that consumes significant amounts of electricity, Ardor’s PoS algorithm ensures energy efficiency while maintaining the security and integrity of the blockchain. This makes Ardor a greener alternative and aligns with sustainable practices, attracting environmentally conscious businesses and individuals.

Additionally, Ardor offers interoperability through the use of “Bundlers.” Bundlers allow transactions from child chains to be included in the parent Ardor chain, enabling seamless exchange of value and data across different applications. This interoperability feature enhances collaboration and synergy between various blockchain projects and networks, fostering overall blockchain adoption and growth.

In conclusion, Ardor (ARDR) is a blockchain platform that addresses the scalability, flexibility, and energy consumption challenges faced by other cryptocurrencies. Its parent-child chain structure, built-in features, and energy-efficient Proof of Stake consensus mechanism make it an attractive option for businesses implementing blockchain solutions. With its interoperability and ready-to-use infrastructure, Ardor provides a versatile platform that can be tailored to meet the specific needs of various industry verticals, making it a significant contender in the blockchain space.

Strategy details

«Top trading strategy ARDR daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘platform’, ‘enterprise-solutions’, ‘state-channel’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)