Last update: 04-03-2025 00:00 UTC

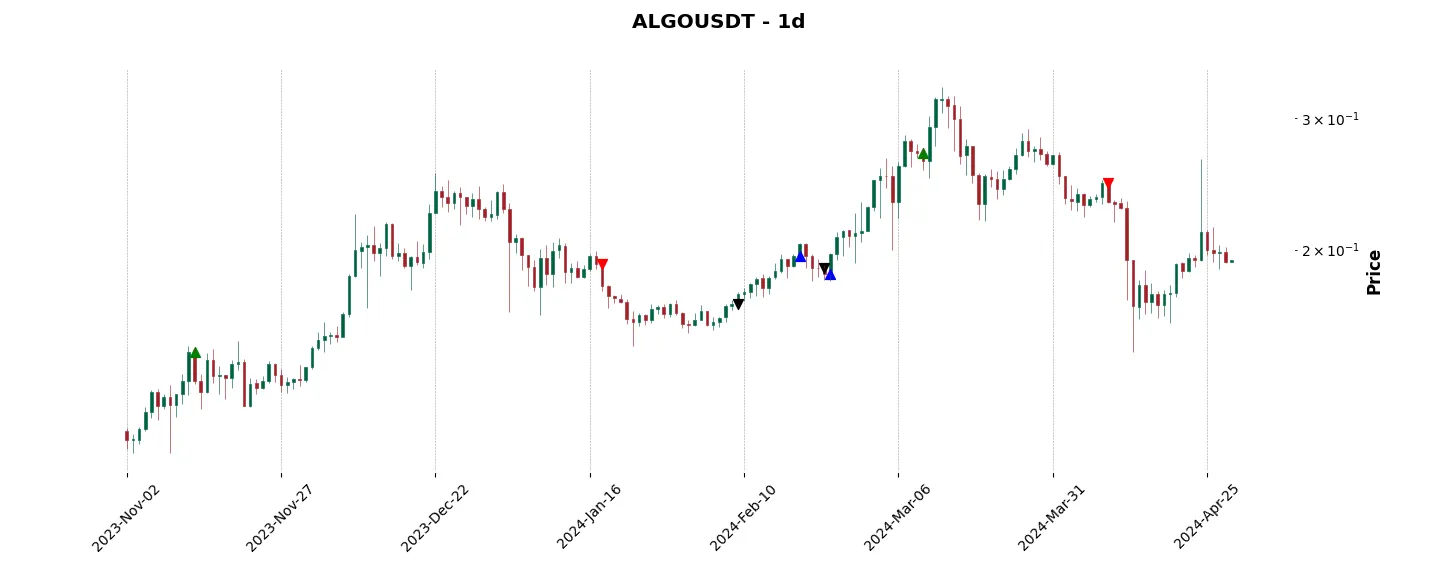

Top trading strategy Algorand (ALGO) daily – Live position:

- Short in progress

- Entry price : 0.2964 $

- Pnl : 19.97 %

Trade history

Over 6 months

Complete

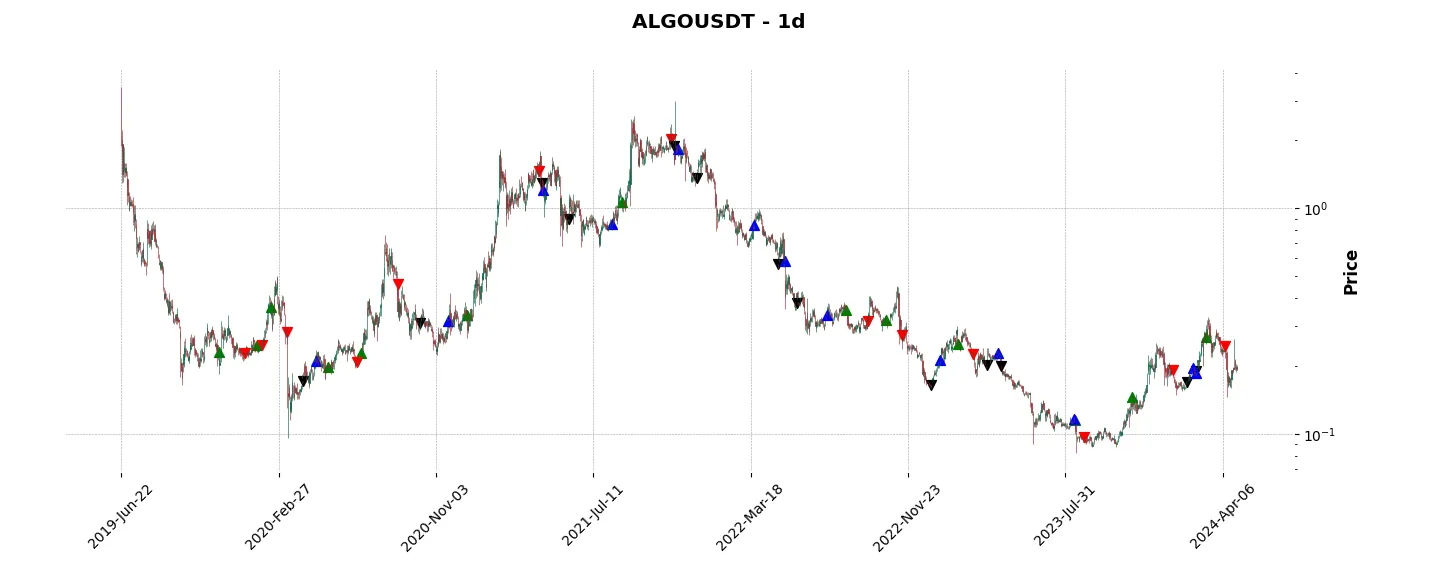

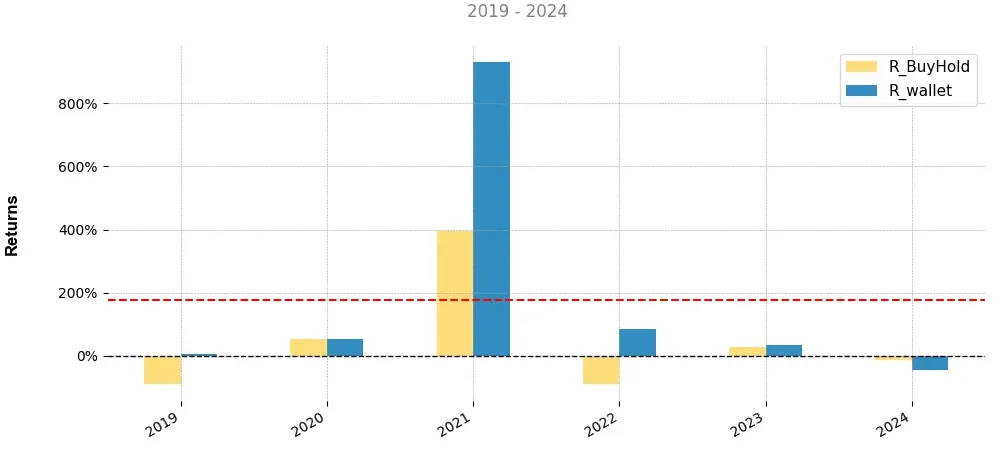

«Top trading strategy Algorand (ALGO) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy ALGO daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

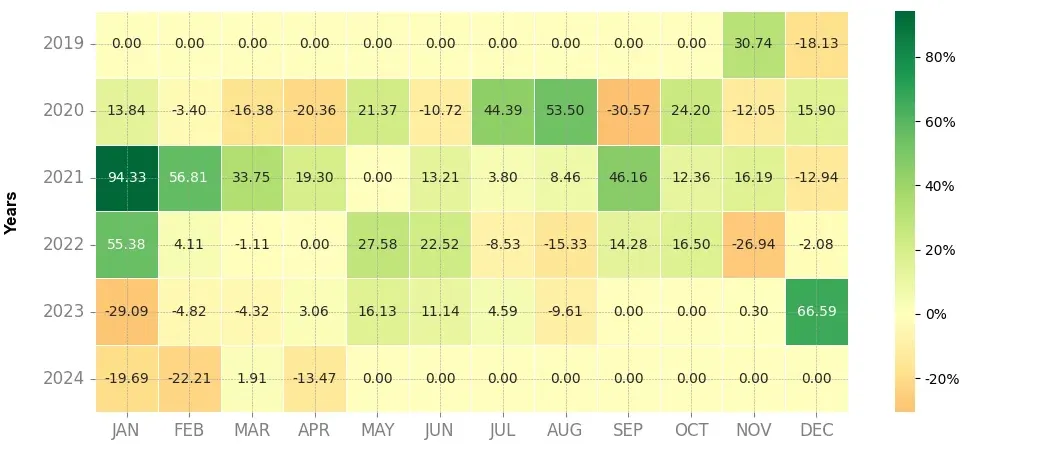

Heatmap of monthly returns

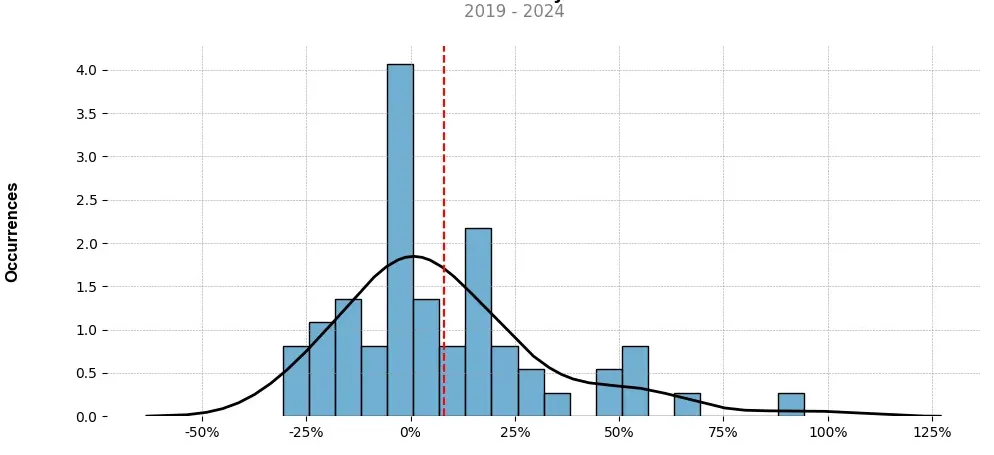

Distribution of the monthly returns of the top strategy

Presentation of ALGO

Algorand (ALGO) is a decentralized cryptocurrency founded by Silvio Micali, a Turing Award-winning scientist and professor at MIT. It is designed to address some of the limitations and challenges faced by other blockchain-based networks. ALGO aims to provide security, scalability, and decentralization while ensuring fast and inexpensive transactions.

One of the key features of Algorand is its pure proof-of-stake (PPoS) consensus mechanism. Unlike traditional proof-of-work (PoW) systems used by cryptocurrencies like Bitcoin, PPoS eliminates the need for energy-intensive mining. Validators are selected randomly to create new blocks, ensuring equal participation and reducing the risk of centralization. This approach also enables fast block finality, allowing ALGO to process transactions in seconds.

Scalability is another area where Algorand excels. By using a unique protocol called cryptographic sortition, it achieves high throughput without sacrificing decentralization. The network can handle thousands of transactions per second, making it suitable for various applications, including financial services and decentralized applications (dApps).

Algorand’s security is bolstered by cryptographic techniques and its Byzantine Agreement algorithm. The protocol ensures that consensus is reached even when some nodes are behaving maliciously or experiencing failures. This guarantees the integrity and immutability of the blockchain.

Furthermore, ALGO is designed to be inclusive and accessible to all users. It does not require specialized hardware or technical expertise, making it easier for individuals and businesses to participate. Additionally, Algorand has implemented a governance model that empowers token holders to actively participate in decision-making processes regarding protocol upgrades and network changes.

The Algorand ecosystem continues to grow, attracting partnerships and collaborations with various organizations, including financial institutions, technology companies, and government agencies. Its versatility and scalability make it an attractive option for building decentralized financial services, such as asset tokenization, stablecoins, and smart contracts.

In terms of sustainability, Algorand has taken steps to address environmental concerns associated with traditional PoW systems. By adopting a PPoS consensus mechanism, it reduces energy consumption and carbon footprint while maintaining a secure and decentralized network.

In summary, Algorand (ALGO) crypto offers a promising solution to the challenges faced by existing blockchain networks. Its PPoS consensus mechanism, scalability, security, inclusivity, and sustainability make it an appealing option for various industries. As the ecosystem continues to expand, Algorand has the potential to become a key player in the future of decentralized finance and blockchain technology.

Strategy details

«Top trading strategy ALGO daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘pos’, ‘platform’, ‘research’, ‘smart-contracts’, ‘arrington-xrp-capital-portfolio’, ‘kenetic-capital-portfolio’, ‘usv-portfolio’, ‘multicoin-capital-portfolio’, ‘exnetwork-capital-portfolio’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)